Delta Capita

Environmental Markets

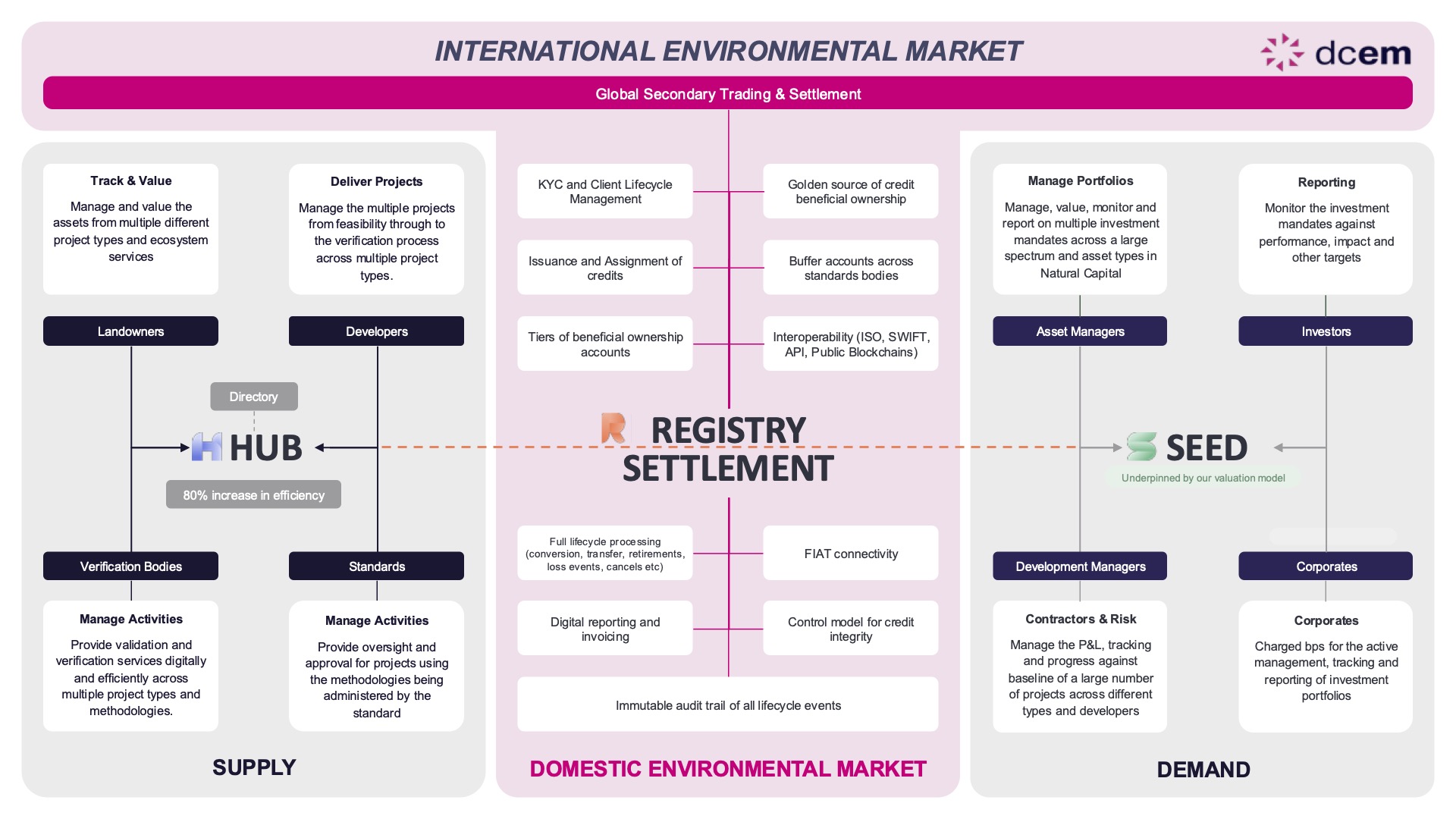

Delta Capita Environmental Markets (DCEM) unlocks the full power of Domestic Environmental Markets for Sovereigns - fuelling environmental regeneration, economic growth, and social transformation as nations decarbonise. By deploying bank-grade digital infrastructure, cutting-edge technology, climate science and capital, DCEM enables investment to flow where it's needed most, on the ground, domestically. DCEM digitally links sovereign-led domestic Environmental Markets with global buyers and corporates under Article 6 of the Paris Agreement. DCEM has built the infrastructure to operationalise Environmental Markets - nation by nation.

DCEM operationalises domestic Environmental Markets through the deployment of proven Market Infrastructure and Environmental Technology enabling Sovereigns to tackle their climate crisis, regenerate their environment, create a sustainable society and generate US$ billions in Climate Finance. Sovereigns need proven, deployable, smart technology, infrastructure, science and capital to turn their Nationally Determined Contributions (NDC) into investable, monetizable assets - fuelling sustainable growth and regenerative, inclusive economies.

As a Delta Capita joint venture, DCEM taps into a global network of 1,500+ professionals and trusted relationships with banks, brokers, and governments. DCEM empowers sovereigns to operationalise transparent, liquid domestic Environmental Markets, generating high-quality environmental assets tradable locally, regionally, and as ITMOs under the Paris Agreement all fully digitalised through its proven Environmental Market Infrastructure.